Instead of chasing a hard and fast “good” quantity, take a look at your personal trendlines. In this instance, you run a small online retailer that sells workplace chairs. Your stock was valued at $150,000 in January and $90,000 in December. The common inventory which is calculated by including the sum of the start inventory and the ending stock.

To calculate a company’s stock turnover, divide its sales by its inventory. Similarly, the ratio could be calculated by dividing the corporate’s value of products bought (COGS) by its common stock. Retailers are inclined to have the highest inventory turnover, but the rate can indicate a well-run company or the trade as a complete. The stock turnover ratio won’t account for seasonal inventory ranges and sales fluctuations. For firms with seasonal products, turnover rates can differ significantly throughout the year. If not thought of contextually, inventory turnover ratios may mislead enterprise house owners and lead to out of date stock.

The ratio measures how usually stock is bought and replaced—it doesn’t mirror the profitability of those sales. A excessive turnover ratio with low revenue margins may not benefit a business as a decrease turnover ratio with larger profit margins. It’s at all times essential for retailers to move by way of their stock, particularly if it’s perishable or time-sensitive (e.g., groceries, cars, or trending clothing). Measuring inventory turnover helps retailers—especially those with delicate inventory—prevent deadstock, poor provide chain planning, and far more. This easy-to-use online calculator lets you input your Value of Goods Offered (COGS) and Common Inventory to compute your inventory turnover ratio mechanically. It’s designed to eliminate guide calculations and provide you with fast, correct outcomes with just two numbers.

- Use this Stock Turnover Ratio Calculator to measure how effectively your corporation manages stock.

- Understanding this number may help you improve your operations, cut costs, and increase income.

- A high value for turnover means that the inventory, on a mean basis, was sold several occasions for building the complete amount of worth registered as price of products bought.

- As An Alternative of chasing a set “good” quantity, take a glance at your personal trendlines.

Inventory Turnover Ratio Calculation Example

A company can improve its inventory velocity by monitoring stock ranges in real-time and stocking up in stock on the right time. Strategic stock distribution and pricing changes can even enhance velocity. Inventory turnover ratio is a well-established metric particularly used for measuring the number of occasions inventory is offered and replaced throughout a given period. Whereas excessive turnover seems constructive, extremely high ratios would possibly indicate understocking, leading to stockouts, lost gross sales, and buyer dissatisfaction. The optimum ratio balances efficient capital use with constant product availability. With the right retail POS system, you probably can immediately gain management of your inventory turnover and meet buyer demand.

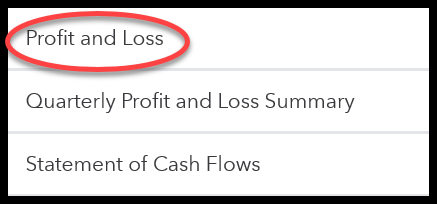

The Method To Calculate Inventory Turnover From A Balance Sheet

A massive worth for inventory days means that the company spends lots of time rotating its products, thus taking extra time to transform them into cash to maintain operations. Conversely, if an organization wants fewer days to eliminate its stock, will in all probability be in a greater monetary position for the explanation that money inflows shall be extra robust. In order to not break this chain (also generally recognized as Cash conversion cycle), inventories need to turnover. The extra environment friendly and the quicker this happens, the more money a company will obtain, making it extra strong against any face-off with the market.

Companies can take more informed monetary choices that are relevant to stock administration. This article covers what the stock turnover ratio is and how to calculate it. Stock turnover ratio measures how efficiently an organization sells and replaces its stock during a selected timeframe.

The ratio can present us the variety of times and stock has been sold over a selected period, e.g., 12 months. We calculate stock turnover by dividing the worth of offered goods by the common inventory. We calculate the common inventory by adding our beginning and finishing inventories collectively and dividing by two.

High-margin merchandise can afford slower turns than low-margin objects, requiring quantity effectivity. For extra precision, many companies calculate common stock using month-to-month or quarterly values rather than simply starting and ending figures. This approach produces extra accurate results for companies with seasonal fluctuations.

Then you’ll have a good suggestion inventory turnover ratio formula calculator of whether or not your turnover price is excessive, low, or average on your trade. Going with the same instance we used earlier than, evaluate your inventory turnover rate of “10” with different bookstores in your space. Days sales of stock (or days of inventory) calculates the average time it takes your small business to show stock into gross sales. You can calculate DSI by taking your average stock and dividing it by the value of items offered.

She brings 6 years of logistics and supply chain writing expertise to her function, together with her current 5-year tenure at ShipBob. She earned her BA from Wheaton Faculty and gained priceless experience in healthcare logistics before https://www.personal-accounting.org/ focusing on ecommerce fulfillment content material strategy. A good on-time and in-full (OTIF) rate ensures the seamless motion of products by way of the system, which displays in a wholesome stock velocity.